Overcollateralization vs Partial Collateralization Markets

The lending protocol is generally regarded as the bank of the DeFi world. Users deposit and lend funds through the lending protocol. Liquidity can be obtained as long as the lender can provide sufficient collateral assets. The total lock-up volume of the DeFi lending protocol has exceeded 12 billion US dollars, and the peak once exceeded 40 billion US dollars, less than 3 billion US dollars two years ago. The development speed of DeFi lending is exciting.

However, even such growth still greatly underestimates the true potential of DeFi, mainly because the vast majority of popular lending protocols currently adopt over-collateralization methods, such as Compound, AAVE, etc.

Taking Compound as an example, the collateralization rate of DAI is 83%, which means that for every $100 DAI deposited as collateral, users can lend assets worth $83. Although this guarantee mechanism reduces debt risk, it also hinders the development of the entire market.

On-chain lending without the blessing of a credit system can only serve leveraged traders and those currency holders who need funds but are unwilling to give up their positions. Those who really need funds but lack the principal cannot benefit from decentralized lending. beneficial.

In this model, the efficiency of capital use is actually low. If you want to enlarge the market size of DeFi and allow more people to benefit from encrypted assets, an excessively high asset mortgage rate is a problem that must be overcome.

The market has been trying to circumvent this inefficient solution, that is, from the initial over-collateralization, the form of under-collateralization is gradually derived. In the non-full mortgage mode, if the protocol can provide 2 times leverage, when users plan to lend assets of $100, they only need to provide $50 equivalent collateral. This is attractive enough to users, and there is no doubt that the demand is huge.

The Development Potential of the Leveraged Defi Market

With the collapse of FTX, crypto users realized the potential risks of keeping their funds in CEXs that lacked sufficient transparency. The entire Crypto market has gradually escalated concerns about the security of users’ funds.

Affected by this, more and more CEX users withdraw their funds, which has led to a major uptick among DeFi protocols and decentralized exchanges (DEXs).

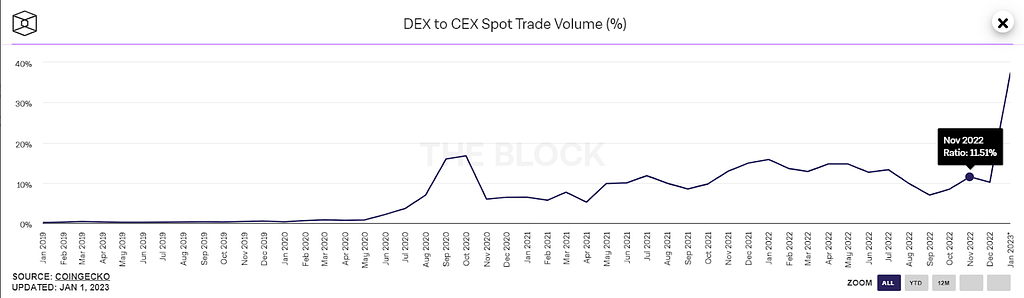

According to the Block, DEX to CEX spot trade volume has increased significantly by nearly 50% compared with the previous month.

When the transaction volume of DEX/CEX increases significantly, there is an increasing number of CEXs that are pointed out to be at risk, and users’ “Coin Withdrawal Campaign” is in progress simultaneously.

The following is the flow of various assets (including stablecoins & ETH) on exchanges in 24 hours (recorded on November 14th, 2022). It is not difficult to see billions of dollars of funds flowing out from various mainstream centralized exchanges.

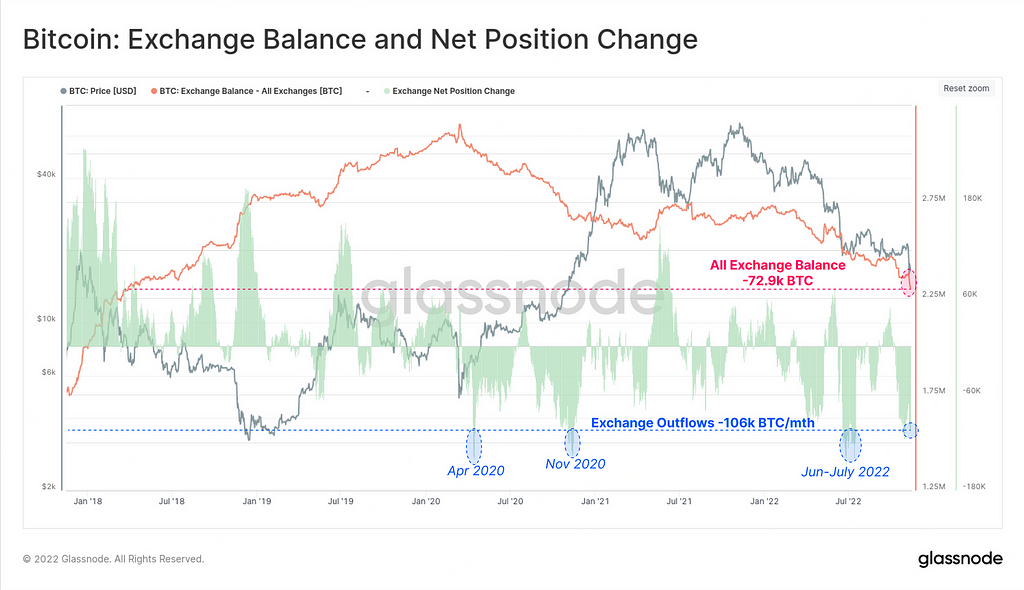

On-chain data from Glassnode show Bitcoin’s movements hit a new record for the largest net decline in aggregate BTC balances on exchanges, reducing by 72,900 BTC in one week.

DeFi protocols and DEX platforms gained some momentum in the aftermath of the FTX implosion.

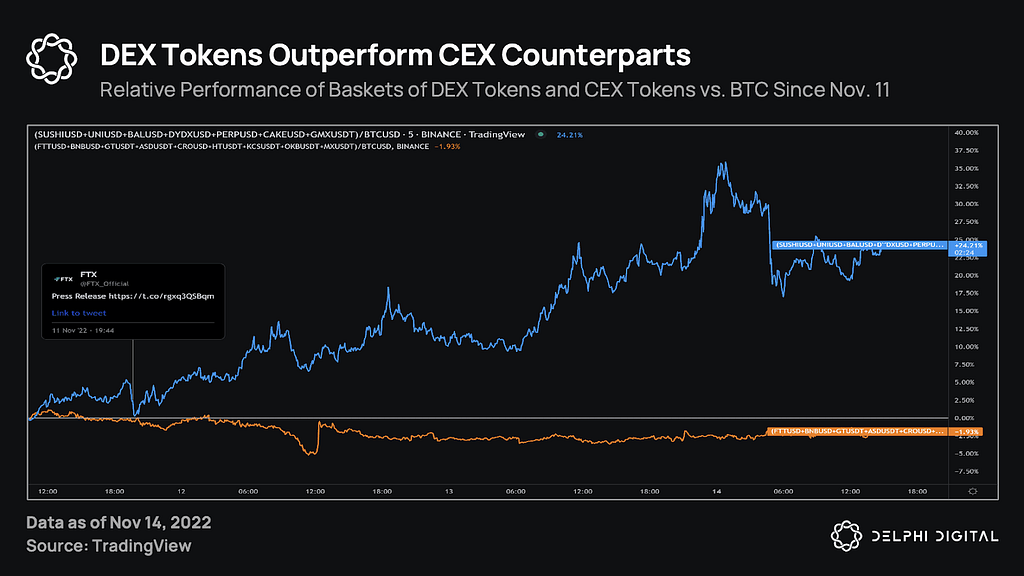

A new report from Delphi Digital suggests DEX platforms gained 24% volume in the wake of the FTX collapse.

Generally, on-chain activity correlates to overall Bitcoin, Ethereum and altcoin market sentiment, with the current FTX chaos catalyzing historic exchange outflows and CEX tokens’ underperformance. A likely trend to emerge from the current chaos is a steady uptick in self-custodied cryptocurrencies and an increase in DEX use.

After the DeFi Summer in 2021, decentralized exchanges developed rapidly, and were quickly welcomed by crypto users because they solved the liquidity problem. At the same time, the liquidity of some mainstream cryptocurrencies is no less than that of centralized exchanges. Therefore, decentralized spot exchanges have become the choice of many users.

Users no longer need to deposit funds in CEXs but can complete transactions by storing them in their own wallets. Decentralized exchanges, especially on-chain derivatives protocols, shined brilliantly in the collapse of FTX. Both the trading volume and the number of new users increased significantly, becoming one of the biggest beneficiaries of this industry crisis.

DeFi derivatives and protocols are attracting significant interest and are emerging as equally important in the crypto space. Ever since the outbreak of crypto derivatives trading in 2019, the market size has continued to expand. In the decentralized world, there have also been a large number of protocols focused on derivatives trading since last year.

As a product with strong user demand, the decentralized derivatives exchange still has a big gap from the centralized products so far. But maybe this is where the opportunity lies. There has not yet been a product similar to Uniswap in decentralized derivatives trading, and more and more protocols are constantly emerging.

As shown in the report from Tokeninsight, the quarterly transaction volume in Q1, 2019 was only $264B, and it increased by nearly 8 times in Q1 2020. In Q1 2021, the transaction volume reached an astonishing $16,590B, which is 62.8 times that of Q1 in 2019. After peaking in Q2 2021, the trading volume of derivatives will begin to decline. In Q4 of the same year, the transaction volume was only about half of Q2. With the end of the bull market in Q4 last year, the follow-up transaction volume continued to shrink.

However, due to the collapse of Terra, the bankruptcy of 3AC, and the application for bankruptcy protection by FTX this year, although the price continued to fall, the sharp fluctuations also caused the transaction volume to decline, but it did not shrink that much.

Advantages of Leveraged Lending

Leverage is a bull market catalyst. In the early stage of the bull market, some radical investors used leverage to buy cryptocurrency or invest in some new projects. The rise of the market gave their mortgage assets a higher valuation, and investors (including some institutions) tended to take active liabilities to expand their own Investment territory. At the same time, leverage is also a symbol of risk. Leverage is widely used in the financial field in various forms. The fundamental reason is that people in the market have different risk preferences.

In the crypto market where high risks and high returns coexist, the user group preference is still more inclined to expand the leverage ratio to more than 1. In the case that mortgage castings cannot generate more objective benefits, users are more willing to use leverage to expand their own. The number of funds, is why flash loans and various other lending models are highly anticipated by the market.

In the traditional financial system with banks as the core elements, banks usually use leverage to provide themselves with a higher level of income, while the official is most concerned about the overall stability of the banking system. Once the banking system is at risk due to leverage, the final result is that the government pays for the banks.

There are no credit and recovery issues in the decentralized anonymous network, and the risks brought by any high leverage are all borne by the leverage user and the leverage provider, which makes the over-collateralization model still the mainstream in the Defi lending market. The common problem with overcollateralization is low capital utilization. In addition, over-collateralization sets a certain holding threshold for borrowers, which is not conducive to the participation of off-market investors and novices.

Although in the over-mortgage model, users can obtain more capital supply through a “matryoshka” method, which is the so-called circular mortgage. Taking the 50% mortgage rate as an example, users can mortgage $1,000 worth of ETH to lend 500DAI, and buy $500 worth of ETH to mortgage again and lend 250 DAI, repeating the cycle, up to 2 times leverage. However, this method of revolving loans and exchanges is very cumbersome for general users, especially novice users, and multiple operations will consume more Gas fees. In this regard, we seek to solve the problem of low capital utilization efficiency through the form of partial mortgage.

Exploration of Partial Collateralization Model

Obviously, the blockchain network has the characteristics of anonymity and trustlessness; how to control the risk of lending is the most important. Especially in the case of partial collateralization, no one wants to lend money to an anonymous person and allow him to spend these funds at will. We have tracked and analyzed several lending protocols with partial collateral characteristics that are popular in the market. A model based on “credit account” has aroused our great interest, and we decided to give priority to further research on this model.

Credit account (core component): The credit account is an independent smart contract, which stores the user’s mortgage assets and credit assets at the same time, and authorizes them to use. The protocol still has the right to manage the credit account. Users cannot directly withdraw the assets in the credit account, but they can invest in other Defi protocols, conduct transactions, Stake, mining and other activities. The credit account manages all risks, and it does not allow users to withdraw the funds at will. When the asset value of the credit account is not enough to repay the debt, the account will be taken over by the protocol and liquidation will be triggered.

System role:

LP (Liquidity providers): like traditional lending protocol, attract investors through deposit interest.

Borrower: The borrower deposits a part of the mortgage position into the credit account, and the protocol will automatically allocate the leveraged position to the account.

Liquidator: Check the health of credit accounts, liquidate accounts with insufficient health and get rewards.

Business Process

1. Liquidity providers deposit assets into the fund pool, and the assets in the fund pool can be borrowed by borrowers to credit accounts.

2. After the borrower opens a credit account, deposit the initial funds and obtain leveraged funds according to the leverage multiple. Both the initial funds and the leveraged funds will be deposited in the credit account, and the borrower can use the funds in the credit account to interact with credible DeFi protocols.

3. If the health coefficient of the credit account is close to 1, that is, the total asset size of the account is close to the credit asset size, then any third-party liquidator can liquidate it, and the assets of the liquidity provider and the corresponding interest will be fully returned to the fund pool Pool. At the same time, the borrower will bear certain penalties, which will be used to pay the rewards of the liquidator.

The Difference between Leveraged Lending and Interest Rate Optimization Mode:

- Leveraged Lending adopts the method of partial mortgage, which significantly improves the efficiency of fund use.

- Leveraged Lending still belongs to the underlying facility of Defi, and the interest rate optimization model provides an optimized entrance based on the liquidity of the existing market.

- Leveraged Lending is more innovative, and its leverage attribute has a wider demand space.

Conclusion

Loan finance is critical to the growth of total economic wealth, and the crypto market is no exception. The next step in the rapid rise of mortgage loans on the DeFi growth curve may be the explosive growth of the leveraged market.

Although the field is still in its early stages of development, many excellent projects are already being explored and developed rapidly. The Defi leverage market has opened a new wave, providing participants in the encrypted capital world with more efficient capital flows.

All suggestions are welcomed!💕 You could contact our admins🎙️ or send emails to [email protected]📧

🔗 Mars Ecosystem useful links

📙 Whitepaper

📈 DAPP

🌎 Website

📝Certik Report

📝SlowMist Report

🎬 Youtube

🤖 Discord

📝 Medium

👾 Join our community

🌟 English Telegram: https://t.me/mars_ecosystem

🌟Chinese Telegram: https://t.me/Marsecosystem_chinese

🌟Indonesian Telegram: https://t.me/marsecosystem_IDSA

🌟Vietnam Telegram: https://t.me/marsecosystem_vietnam

🌟Turkish Telegram:https://t.me/marsecosystemturkey

🌟Spanish Telegram: https://t.me/marsecosystem_ES

🌟Russian Telegram: https://t.me/marsecosystem_cis

🌟Portuguese Telegram: https://t.me/marsecosystem_Pt

🌟French Telegram: https://t.me/marsecosystem_french

🌟Thailand Telegram: https://t.me/marsecosystem_thailand=

👨🚀 Great things are on the horizon and together we will build a New Decentralized Stablecoin Era!

Yours sincerely,

The Marsecosystem Team

View more

View more