The importance of Lending Platform in DeFi

The growth of DeFi has been substantial since the DeFi Summer in 2020 when borrowing and lending platform Compound introduced its COMP governance token, which it used to reward its users in a process called liquidity mining. Such rewards, paid in COMP, dramatically increased yields, made more complex yield farming strategies possible, and allowed token holders to participate in governance. As other protocols mimicked these concepts, users piled into DeFi, token prices increased, and DeFi activity in general skyrocketed.

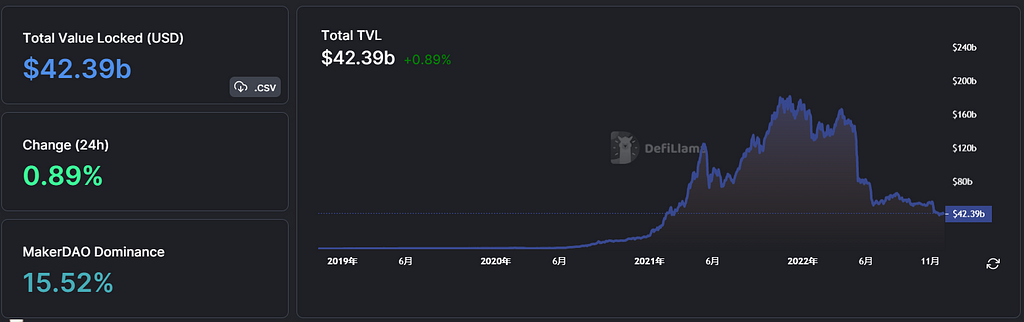

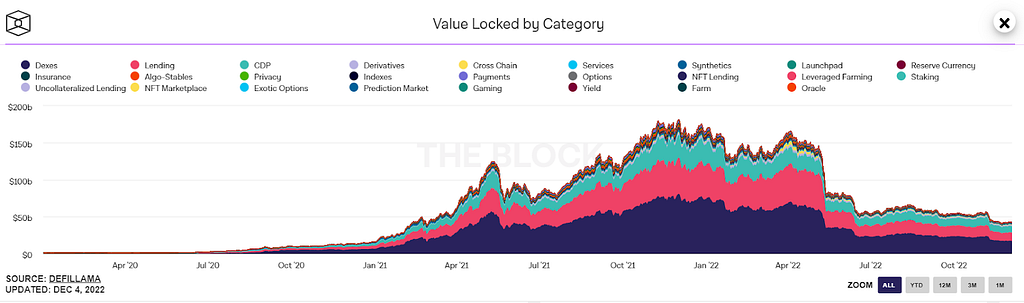

However, the ‘DeFi summer’ has now given way to the ‘crypto winter. The downfall of crypto exchange FTX is just the latest in a series of problems contributing to 2022’s crypto winter. According to DeFiLlama and The Block, the total value locked in DeFi decreased from $180 billion in December 2021 to $42 billion so far in 2022 with most of the funds allocated to lending protocols and DEXs. DEXs and lending & borrowing platforms have become a tremendous part of the DeFi ecosystem.

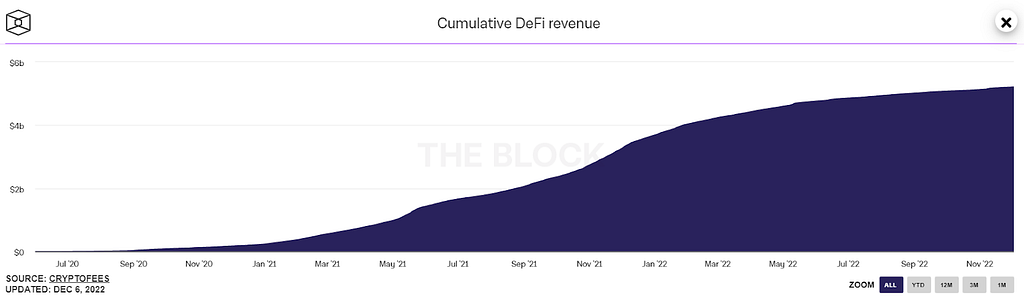

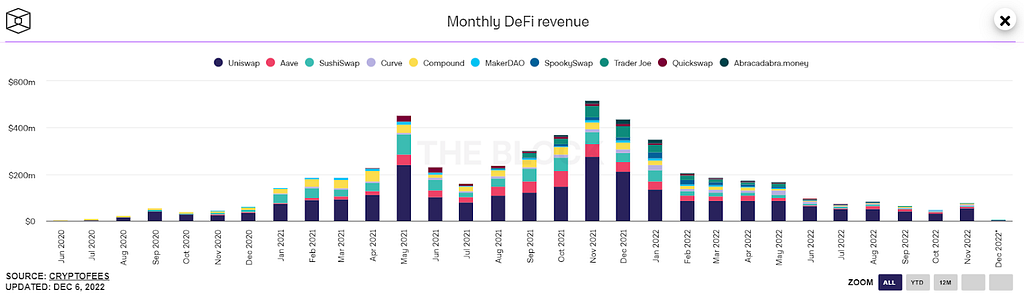

Monthly revenue generated by popular DeFi protocols continued to decline as usage slowed across major DeFi protocols. The total monthly revenue as of November month-end was $77 million. Meanwhile, cumulative DeFi revenue continued to make new all-time highs, growing to over $4.2 billion since June of 2020.

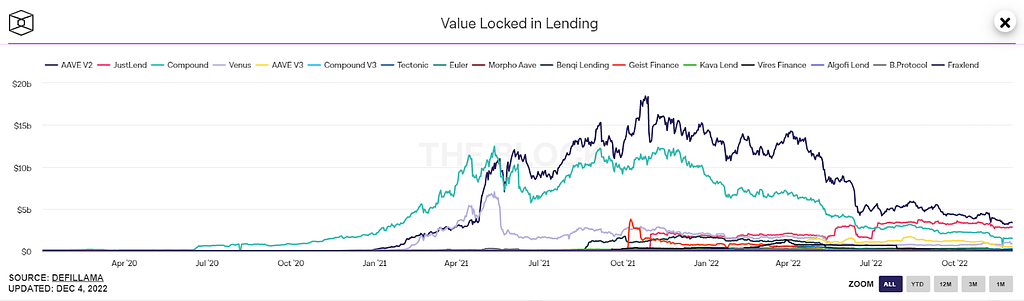

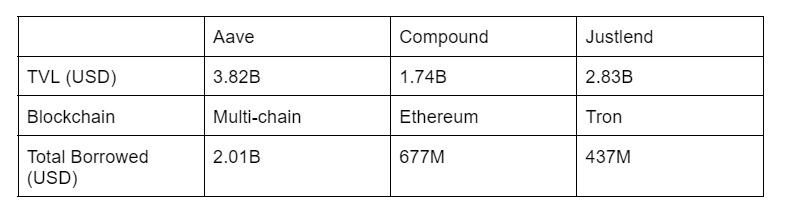

According to the Block, the total value locked in DeFi lending protocols peaked at $50 billion in early 2022, up from nearly zero in end-2020. The top three lending protocols by TVL are Aave, Justlend, and Compound, with TVLs of $3.82 billion, $2.83 billion, and $1.74 billion, respectively.

The crucial feature of DeFi lending is that it relies heavily on crypto collateral. Aave and Compound offer investors an opportunity to borrow funds against their idle crypto tokens as collateral or lend their cryptocurrency for fairly competitive interest rates. Both Aave and Compound are non-custodial, which means that the lender’s cryptocurrency remains in the owner’s wallet, and the platform doesn’t take electronic custody of it. Having full custody of your digital assets was one of the primary motivations for the invention of cryptocurrencies over a decade ago, and DeFi advocates point to this feature as a necessity for decentralization.

A common feature of these widely used lending protocols is that all loans issued must be overcollateralized. If the position is deemed to be at risk (when the position falls below a certain minimum collateralization ratio), the custodian can force liquidation of the collateral to pay off the outstanding debt. That way, loans can be drawn out anonymously and trustlessly, while reducing the risk of protocol bankruptcy should delinquent borrowers default.

However, while these famous lending protocols provide excellent value to users, most of these solutions run on top of Ethereum and cause high gas fees. With so many DeFi users being tempted to alternative layer one blockchains due to Ethereum’s high fees, Venus Protocol came out as the alternative for being a crypto lending protocol within the BSC ecosystem that introduced additional functionality by allowing users to mint synthetic stablecoins on their cryptocurrency collateral. It’s a fork of the Ethereum-based money market protocols MakerDAO and Compound Finance. What separates Venus from other lending platforms is how it implements its own synthetic stablecoins — cryptocurrencies that maintain a stable long-term value without holding real-world reserves of the assets they are pegged to (e.g., via algorithms, ecosystem incentives, or using other forms of collateral) — into the ecosystem.

Lending in DeFi — A lucrative business

Every day, companies and businesses are looking to develop their DeFi lending protocols and reap the rewards. What makes them so keen on lending? Perhaps we can find the answer in the figures.

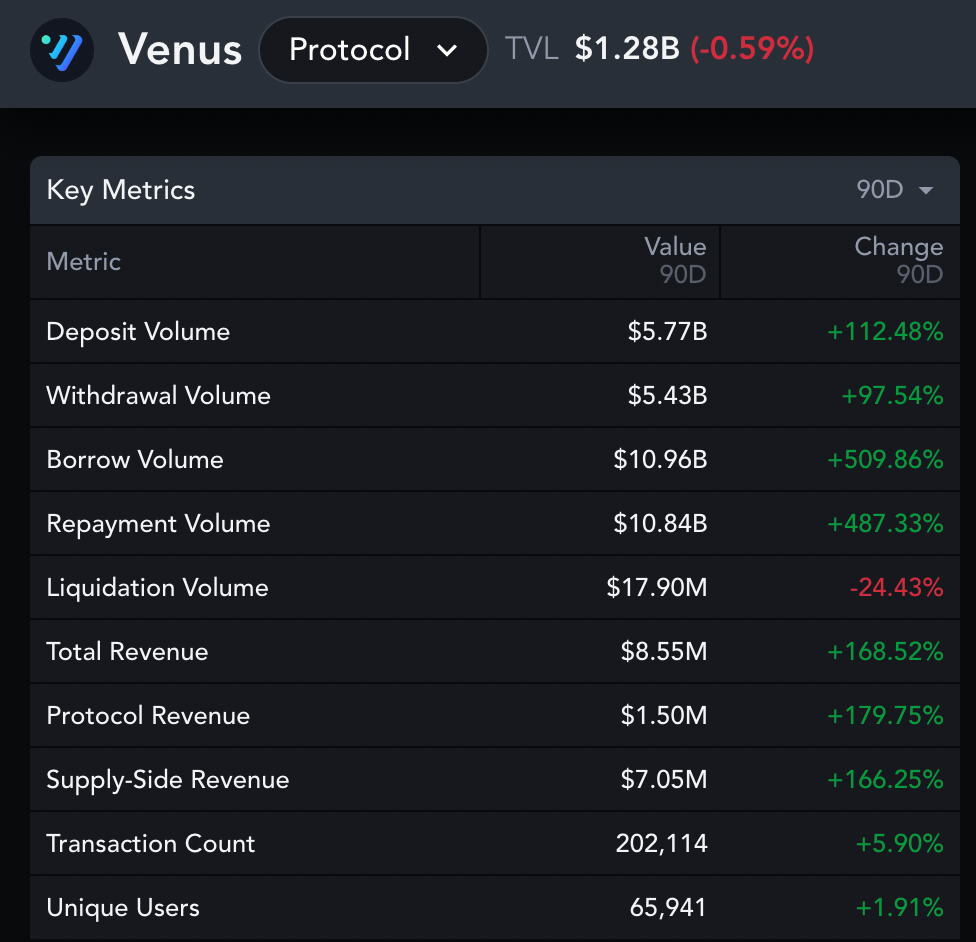

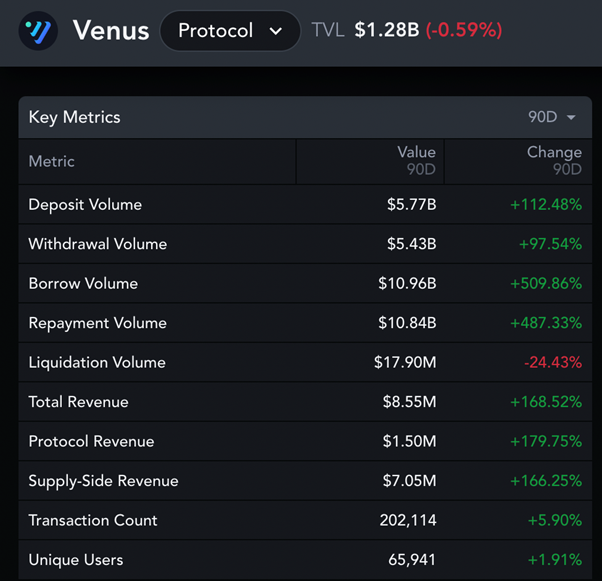

A quick look at the key metrics shown on Messari seems to indicate that Venus stood out from the siege in a desolate industry environment and performed excellently in all aspects. By combining the benefits of Compound and Maker as well as leveraging synthetic stablecoins and BSC’s high scalability, Venus offers a convenient way for users to generate a passive income, borrow funds, or mint VAI without stability fees. Despite the recent bearish market, Venus’s revenue in the last 3 months totalled $1.5 million, having increased nearly 180%.

Model of existing lending business

Unlike in traditional finance borrowers can be identified and standard assets are available as collateral. market participants in DeFi are anonymous. Assessing the risk of borrowers through time-tested methods — from banks’ screening to reliance on reputation in informal networks — is therefore not possible. Whereas financial intermediaries have, throughout history, focused on improving information processing, DeFi lending in its current form has reversed this trend and tries to perform intermediation without gathering information. Instead, it requires borrowers to post collateral.

The crucial feature of DeFi lending is that it relies heavily on crypto collateral. Defi lending platforms aim to offer crypto loans in a trustless manner, i.e., without intermediaries and allow users to enlist their crypto coins on the platform for lending purposes. A borrower can directly take a loan through the decentralized platform known as P2P lending. Besides, the lending protocol allows the lender to earn interest. Among all of the dApps, DeFi has the highest lending growth rate and is the most prevalent contributor for locking crypto assets.

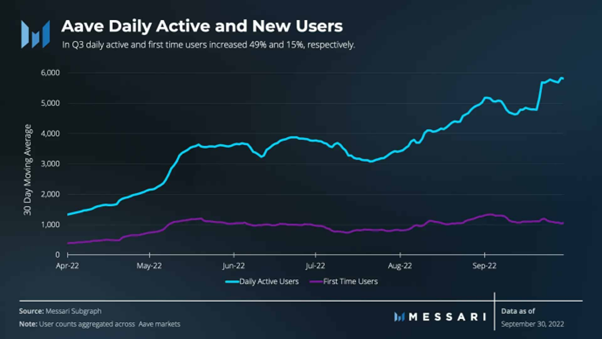

As reported by Messari, Aave saw a surge in overall user activity in Q3. Daily and first-time users on the crypto lending platform grew by 49% and 15%, respectively. Even in the current Crypto Winter period, there are still a lot of users rushing into lending platforms and looking for a way to make profits.

While established lending protocols have long dominated, the lending landscape is becoming more diverse as new lending platforms fine-tune and target different niche audiences. In this way, Mars Ecosystem is also considering developing lending products as a way to increase protocol revenue and bring more practical benefits to our users

Model of existing lending business

Unlike in traditional finance, borrowers can be identified and standard assets are available as collateral. market participants in DeFi are anonymous. Assessing the risk of borrowers through time-tested methods — from banks’ screening to reliance on reputation in informal networks — is therefore not possible. Whereas financial intermediaries have, throughout history, focused on improving information processing, DeFi lending in its current form has reversed this trend and tries to perform intermediation without gathering information. Instead, it requires borrowers to post collateral.

The crucial feature of DeFi lending is that it relies heavily on crypto collateral. Defi lending platforms aim to offer crypto loans in a trustless manner, i.e., without intermediaries and allow users to enlist their crypto coins on the platform for lending purposes. A borrower can directly take a loan through the decentralized platform known as P2P lending. Besides, the lending protocol allows the lender to earn interest. Among all of the dApps, DeFi has the highest lending growth rate and is the most prevalent contributor for locking crypto assets.

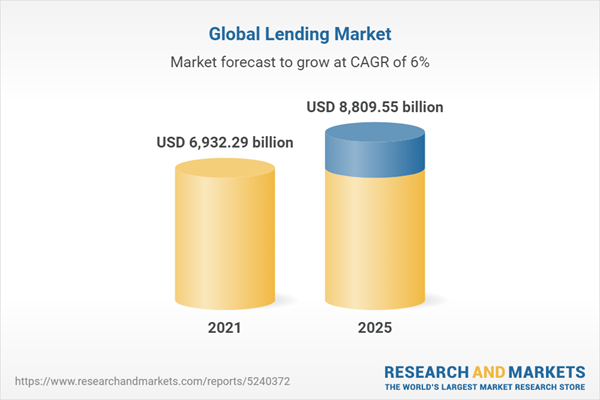

According to Research and Markets, excluding the value of outstanding loans, the modern global lending market is currently valued between $7–8 trillion, based on the money made on interest by all private and public institutions.

Peer-to-Peer

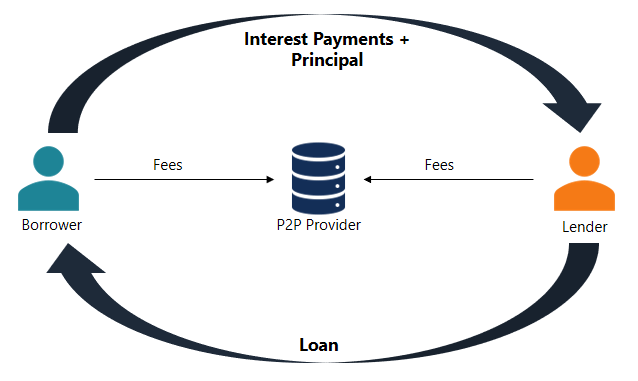

Peer-to-peer lending enables individuals to obtain loans directly from other individuals, cutting out the financial institution as the middleman. The P2P model differs in that every loan has a distinct borrower and lender. If the user wants to provide a loan, then he will have to wait for a borrower to take the other side, and vice versa, making it harder to attract initial liquidity to the platform. It aims to reduce the costs of intermediary parties, such as banks, so that lenders can earn greater interest on their loans and borrowers can receive loans for less interest. The biggest advantages of the P2P model are that it the highly efficient and the funds can be fully matched accordingly.

In the traditional lending market, the P2P usually goes as follows:

- The borrower provides collateral and issues a loan order.

- The lender can browse the order book to find the interest rate quotes they accept, and receive the borrower’s collateral after the order is completed.

- When the contract expires, the borrower repays the principal and interest to the lender and gets back its collateral. If the borrower defaults, then the lender gets the borrower’s collateral.

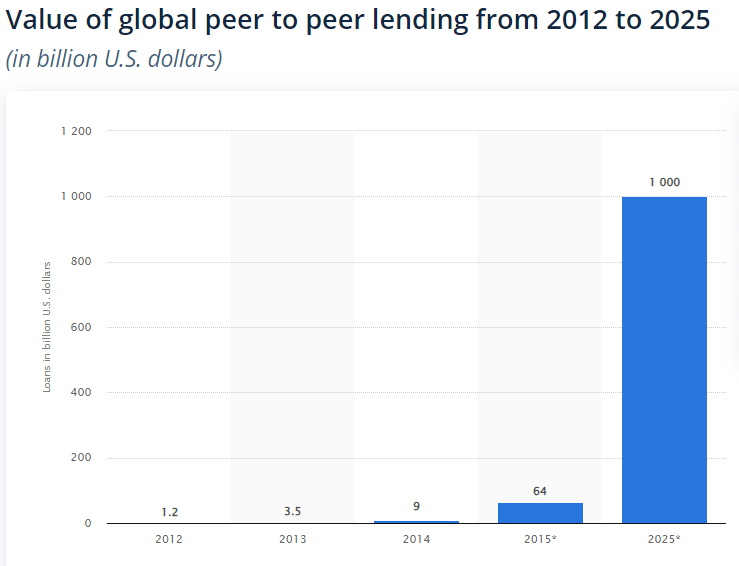

While institutions now have a firm grip on lending, enabling greater access to individual lenders through DeFi can help provide higher yields on one’s assets by eliminating the need for middlemen. In fact, by 2025, the peer-to-peer lending market is expected to reach $1 trillion in value. This rapidly changing environment is being eyed by many DeFi protocols. They gaze at an extremely profitable market, as our financial system has started rolling over to transparent ledgers i.e. blockchains. While DeFi presents an option for a decentralized and trustless financial future, undercollateralized (UC) lending is the current bottleneck in accelerating DeFi adoption.

Peer-to-Pool

The concept of peer-to-pool has been proposed as an ideal alternative to the extant peer-to-peer model. Unlike peer-to-peer, peer-2-pool is a system where lenders supply liquidity or tokens to an asset pool. Instead of interacting with a single user or peer as prevalent in the peer-to-peer model, peer-to-pool would require borrowers to take tokens or liquidity from the communal pool.

These pools — managed by smart contracts VM-compatible blockchains — algorithmically and dynamically determine the interest rates lenders earn and borrowers pay. In other words, the interest rates are calculated automatically with no intermediary party needed, thus significantly reducing costs. Interest rates are determined algorithmically based on market factors surrounding the demand for credit.

From a user’s perspective, this is a great model since they are free to enter/exit as they wish while having a more predictable interest rate. The Compound protocol, which introduced this concept, referred to such pools as Money Markets (MMs). Users enter and exit a MM (as lenders or borrowers) according to the rates that the Market quotes.

As a major innovation in the DeFi field, this peer-to-pool model has the following advantages:

● Instant liquidity

● Stable interest

● Transparent interest rates

● With no repayment date, interest accrues on the debt

However, due to the excess mortgage rate, there are the following disadvantages:

● The capital utilization rate is low, and some Suppliers are idle because they cannot match the Borrower

● All the supply side squares the lender interest, resulting in excessive interest rates for both borrowers and lenders.

An idea for Mars Ecosystem’s new lending product

Generally, in the lending market, the scale of deposited funds is usually larger than the scale of lent funds, and all depositors share the interest paid by borrowers, which results in higher borrowing rates and relatively lower deposit rates.

So is there a model that can have the advantages of peer-to-peer and peer-to-pool at the same time? That is to say while allowing the market to have more liquidity, it can also take into account higher efficiency in the use of funds. With our continuous exploration of the lending market recently, we have developed the following idea:

- Based on an underlying lending market with sufficient liquidity,2-layer2 layer logic is created.

- On top of this 2- logic, a set of optimization rules is established, which sets a certain priority and other selection logic, and redistributes user deposits and loans.

- If the combination of deposit funds and loan funds is successful, then this part of the funds can reach 100% utilization rate, and the optimized deposit rate and borrowing rate will be obtained immediately.

- Unmatched funds will continue to enter the underlying lending protocol to ensure that at least the base interest rate of the underlying protocol can be enjoyed.

For example:

- User A deposits 100 DAI tokens. At this time, there is no loan of DAI. The 100 DAI will be deposited into the underlying lending protocol and enjoy the Supply APY based on the underlying lending market;

- User B deposits $100 worth of ETH. Assuming the collateral rate is 80%, user B can borrow 100 * 80% = 80 DAI from the DAI pool.

- At this time, the 2-tier structure will recombine the 80 DAI lent and the 80 DAI deposited by user A, and the efficiency of capital utilization after the combination is 100%, and both the borrower and the depositor will enjoy better interest rates.

- If the Supply APY of the underlying lending market = 1.5%, Borrow APY = 3.2%, assuming that we use the most intuitive optimization method, then the optimized borrowing rate and lending rate will be optimized at the same time as (1.5% + 3.2%) / 2 = 2.35%

Note: The example is only used to express the principle and does not consider the income of the protocol, the actual process may be slightly more complicated.

5. At this time, of the 100 DAI deposited by user A, 80 DAI has been recombined and enjoys the optimized deposit interest rate, while the remaining 20 DAI still maintains the underlying basic deposit interest rate.

6. When user A wants to withdraw his money, the Layer 2 protocol will find another fund from the deposit list to replace him, because user B does not want to repay at this time.

In terms of more detailed design, we consider setting up a selection queue mechanism to manage different users’ deposit orders and loan orders. When there is a new lending behaviour, the protocol mechanism will match the order according to the established rules and update the funding rate of the successful combination.

At the liquidation level, we will maintain consistency with the underlying market to the greatest extent, so that there will be no additional liquidation risks for the second layer unless the entire second layer collateral value cannot cover the user’s loan, which is in the deposit market after having a certain amount of capital, it will hardly happen.

In addition, we still need to consider the issue of portfolio efficiency, specific user behaviour and debt calculation issues in the underlying market, and liquidation risk assessment, etc. This does not seem to be an easy process. Currently, the Mars team is continuing to discuss and refine the solution, and constantly improve the design of the detailed logic.

We believe that whether it is blockchain technology, or Defi and decentralized lending products, there will be broad room for development in the future. Especially the lending products used as Defi infrastructure, with the expansion of the blockchain market, there will inevitably be substantial growth. Mars Ecosystem is committed to building the central bank of the Defi world. Lending products are very suitable for the development goals of Mars, and can also bring more income possibilities to the Mars system.

🔗 Mars Ecosystem useful links

📙 Whitepaper

📈 DAPP

🌎 Website

📝Certik Report

📝SlowMist Report

🎬 Youtube

🤖 Discord

📝 Medium

👾 Join our community

🌟 English Telegram: https://t.me/mars_ecosystem

🌟Chinese Telegram: https://t.me/Marsecosystem_chinese

🌟Indonesian Telegram: https://t.me/marsecosystem_IDSA

🌟Vietnam Telegram: https://t.me/marsecosystem_vietnam

🌟Turkish Telegram:https://t.me/marsecosystemturkey

🌟Spanish Telegram: https://t.me/marsecosystem_ES

🌟Russian Telegram: https://t.me/marsecosystem_cis

🌟Portuguese Telegram: https://t.me/marsecosystem_Pt

🌟French Telegram: https://t.me/marsecosystem_french

🌟Thailand Telegram: https://t.me/marsecosystem_thailand

👨🚀 Great things are on the horizon and together we will build a New Decentralized Stablecoin Era!

View more

View more