TL;DR

- allows an easy entrance and exit to DeFi Insurance Staking

- No KYC, no withdrawal queue

- Low risk due to wide diversification

Start staking now https://app.brightunion.io/provide-cover

Why become a DeFi Insurance Capital Provider?

The decentralized finance (DeFi) industry is experiencing a surge in popularity. An increasing number of DeFi investors have recognized the importance of insuring their assets against potential risks such as hacks, exploits, and stablecoin de-pegging. To ensure that there is enough capital to underwrite these insurance covers, attractive rewards are offered to those who provide the capital. This has resulted in a new investment opportunity for the DeFi community, which is supported by a concrete business model.

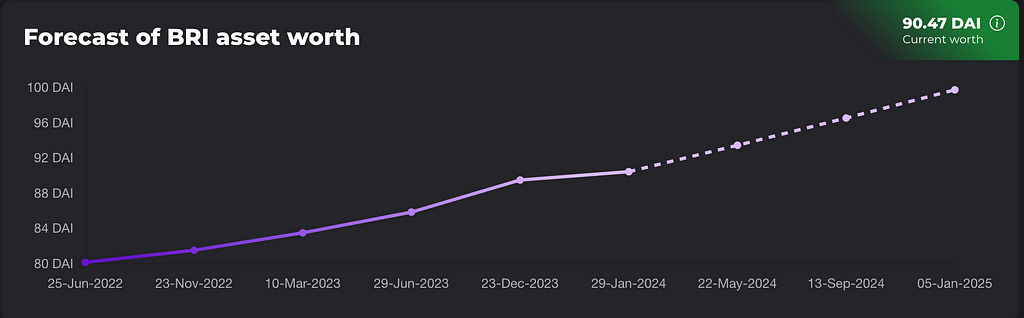

Investors who provide capital for insurance coverage can expect to earn rewards ranging from 5% to 8% APY. These rewards are independent of market conditions, meaning they are not affected by whether the market is bullish or bearish. The investments are primarily made in stablecoins, which have limited market risk. The amount of rewards paid out is based on the demand for insurance coverage and fees paid.

Insurance is a profitable industry despite the risks involved. This is because of the modern portfolio theory which states that by diversifying risks, it is possible to create a portfolio that has the highest possible return for the lowest level of risk. However, investing in individual insurance pools can be risky because the value at risk can be as high as 100% in case of a hack or protocol failure.

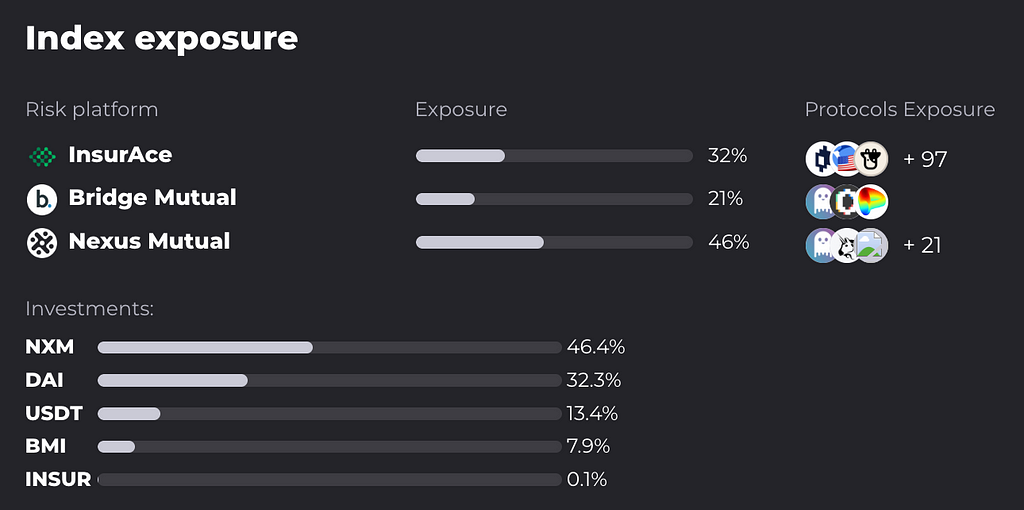

The Bright Risk Index helps you create a diversified portfolio by spreading the risk across multiple pools. This reduces the value at risk to only 12%. By investing in the index, you can earn an excellent return on your capital while also contributing to making DeFi a safer space. Your capital will enable other users to buy insurance and have peace of mind.

It’s a win-win situation for all!

Why diversify with Liquid Risk Staking?

Since the crypto space is permissionless, why not invest in insurance pools yourself?

The Bright Risk Index simplifies DeFi insurance pool investments.

The Bright Risk Index is a diversified investment that represents many insurance pools across different risk platforms. It offers the best risk/reward ratio in the DeFi insurance market, as it invests based on the demand for coverage. The DAO is responsible for voting to allocate capital to the pools, saving investors time to focus on exploring other investment opportunities.

Gas fees are greatly reduced by combining many transactions into a single bulk transaction.

Investing capital through the $BRI is more liquid compared to direct investments. When you invest through $BRI, you will receive $BRI tokens that are freely tradable in the market. This means that you don’t have to deal with lock-ups or cooling down periods which are usually in place with direct investments in any of the insurance pools..

Investment rewards are claimed and reinvested into the insurance pools, which means that the $BRI auto compounds every month and accrues value without any action required from the investors.

One of the innovations “under the hood” is that staking positions are made permissionless, meaning you can become a cover liquidity provider without providing KYC.

Why Bright Risk Index:

- over 200 DeFi protocols your investment will secure

- over 3 insurance protocols, liquidity gets spread over

- no withdrawal queue, no KYC

- proven history of more than a year of stable yield

Stake now https://app.brightunion.io/provide-cover

Join the Union

Be Bright and #JointheUnion. Receive announcements by joining the community.

🌍 Check out the website.

🤝 Discuss Bright by joining Telegram or Discord

🗞️ Get the latest news on Twitter @Bright_Union.

📺 Watch tutorials on Youtube

📸 Follow us on Instagram

View more

View more