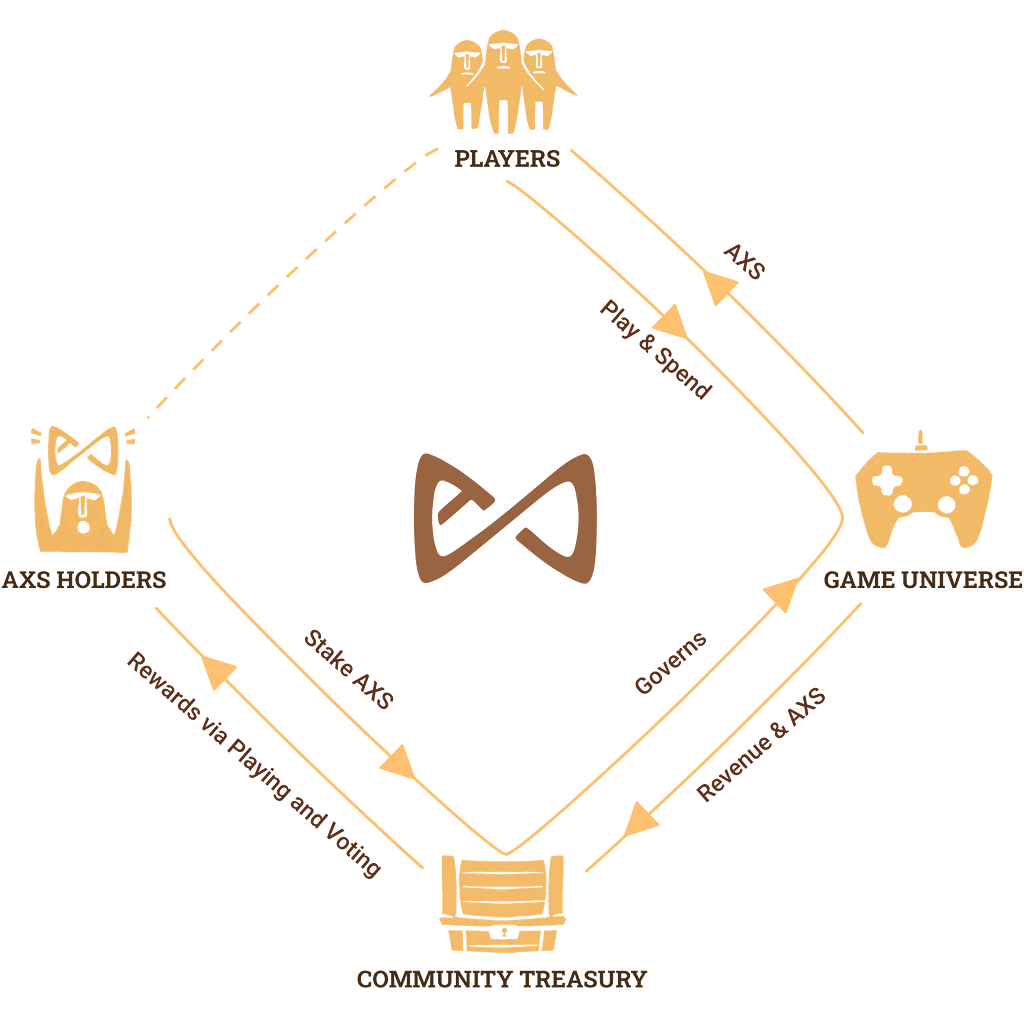

With the recent launch of AXS, we think it makes sense to dive a bit deeper into one crucial aspect of the Axie ecosystem, the Community Treasury.

The Treasury is at the heart of the feedback loop that drives AXS demand within our ecosystem. Let’s dive in and learn more!

Fees & Primary Sales

Once it’s live, 100% of all fees and primary sales from the Axie universe will be deposited in the Treasury.

The Axie ecosystem has a variety of different fees.

For now, there is a 4.25% marketplace fee as well as a .005 ETH fee for breeding Axies. Over the last 30 days, these fees have totaled over 400 ETH.

Here’s how to track this:

- This is the Ethereum-based Axie marketplace contract. If you go to the analytics tab you’ll be able to see the Marketplace fees accumulate over time.

- This is the Axie breeding contract. You can track the fees over time just like with the marketplace contract.

- To track fees from land and item sales, you can use Axieworld.com’s land volume chart.

Let’s calculate the hypothetical accrual to the Treasury over the period of October 23rd — November 23rd. Please note that this is only hypothetical as the Treasury is not live yet.

In the last month, there was 4838.8 ETH in Axie sales and 1,429.7 ETH in land/item sales. This gives us 6,268.52 ETH in total marketplace volume. 4.25% of this is 266.4 ETH. Lastly, the breeding contract shows us that 161.45 ETH was spent breeding Axies in the last month.

This means that if the Community Treasury were live, 266.4 + 161.455= 427.855 ETH would have been deposited just from the last month of activity.

Keep in mind that this is more fees generated than many of the products and networks in the CoinGecko top 20.

Use of the Treasury

The Community Treasury will create a base value for the AXS token. Why? Since the treasury will eventually be governed by AXS holders, the minimum market cap for AXS will be influenced by the size of the Treasury. For example, if there were 5,000 ETH in the Treasury, it wouldn’t make sense for the circulating market cap of AXS to be significantly lower than this since over time, this will be distributed back to stakers. To kick this process off, Delphi Digital has proposed sending 5% of the Community Treasury to stakers each week. Besides fee-sharing, here are some additional factors that will effect the value of AXS.

- Monetary premium for AXS.

- Additional utility such as marketplace fee discounts and access to certain exclusive sales.

- Use of the community Treasury. For example, the Treasury funds could be seen as a sovereign wealth fund for the Axie universe. Fund managers or systems such as YFI could be appointed to grow the value of the assets stored inside the Treasury

Scaling Treasury Inflows

Once the Treasury is live, it’s likely that the Axie community will eventually turn its eye towards new monetization strategies.

Here are a few potential paths:

- Revenue from cosmetic sales. While skins for parts could be harder to introduce, things like rare pets, skins for summons, and animations could be a hit.

- Axie tattoos & emotes. Rare emotes would be awesome for things like the arena and land play.

- Licensing cuts from 3rd party content built on top of Axie.

- Tournament entry fees and tickets.

- Marketing fees from other organizations. Rather than donating tokens to “seasons” as partners have done in the past, sponsors can directly put assets into the Treasury. These contributions can be distributed through a lottery format to stakers/voters.

Staking Rewards

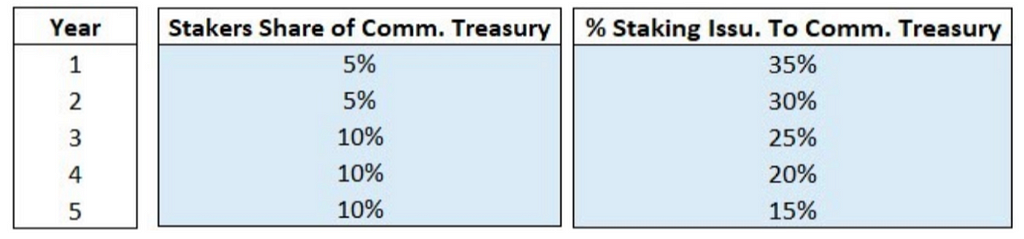

A portion of staking issuance will also be directed towards the Community Treasury. This percentage starts high at 35% and gradually tapers off over time. Here’s a a nice overview of how staking and the Treasury interact from Delphi Digital:

“AXS stakers earn both staking and Treasury yield. Staking yield consists of funds that move from the Axie staking multi-sig directly to stakers. Treasury yield consists of funds that move out of the Treasury to stakers. The underlying Treasury funds are made up of AXS tokens sent to the Treasury (from staking issuance) and exogenous network revenue(stablecoins and ETH). Over the 5 years, we suggest sending staking issuance to the Community Treasury starting at 35% in year 1 and scaling down to 30%, 25%, 20%, and finally 15% in year 5. With these values, AXS stakers still earn an attractive base yield in the early years and an attractive Treasury yield in the latter years. The logic here is that exogenous cash flows should makeup more of AXS staking yield as the Axie ecosystem matures. Based on projections, total yield (base + Treasury) should sit ~40% across the first five years.”

Keep in mind that in order to achieve max rewards, stakers will be required to perform some type of work such as playing the game. These work requirements themselves may be something determined by governance over time.

Conclusion

The Community Treasury promises to be a powerful force within the Axie community by accruing value and distributing it to AXS stakers. If we fulfill our goal of ensuring that AXS is held and staked by a diverse and representative cross section of the Axie community, then the Treasury will act as a unifying force that drives the ecosystem forward for years and perhaps generations to come.

Still have questions?

View more

View more